EVENTS IMAGINED

BRANDS ELEVATED

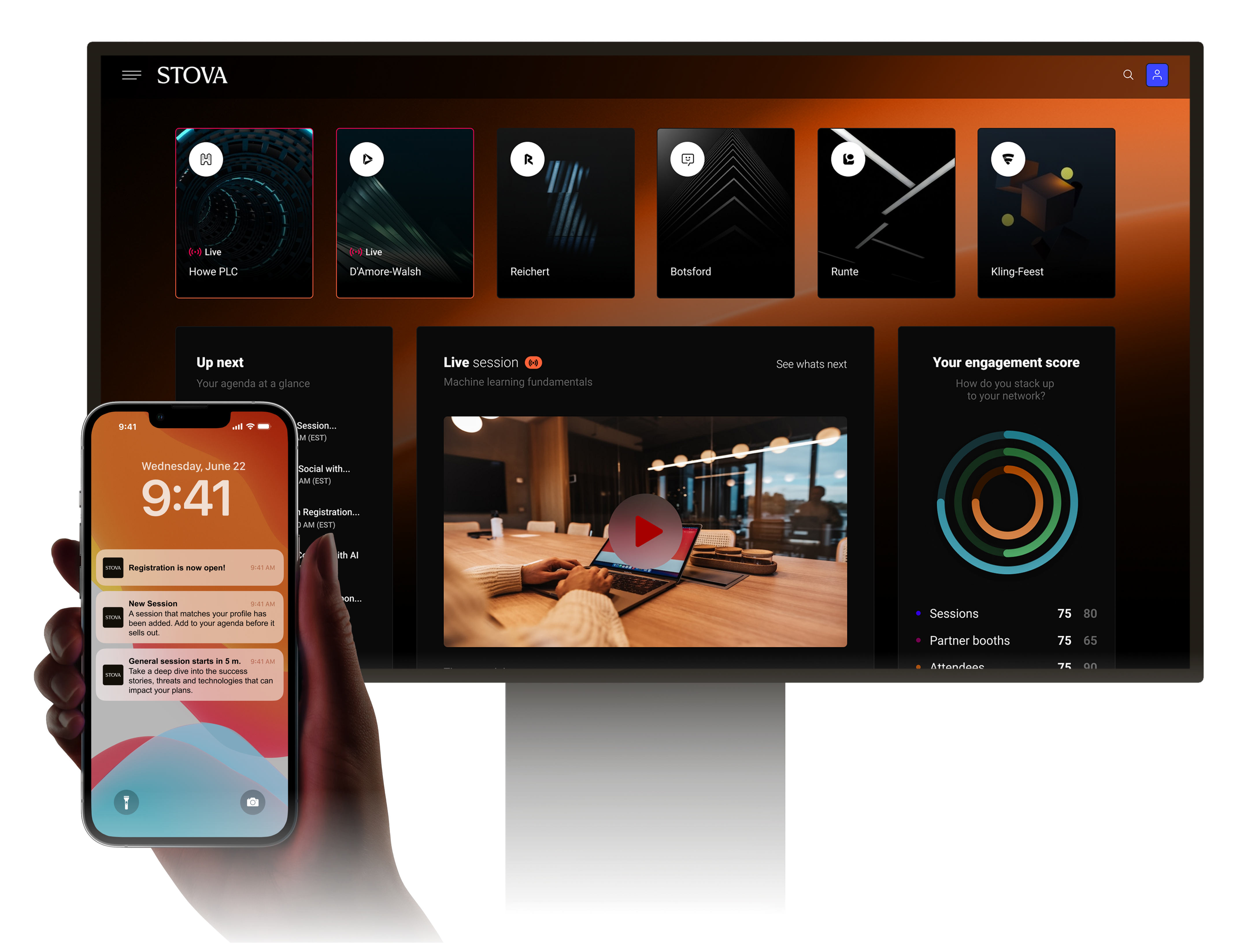

Stova is the definitive event technology ecosystem with end-to-end solutions designed to flex for any event no matter the size or location. Our event management solutions have the power and flexibility global enterprises need, and the scalability that event organizers love.

Airbus

Databricks

Villanova

Tableau

Microsoft

Valve

CES

HSBC

United

Marriott

PepsiCo

Informa

Airbus

Databricks

Villanova

Tableau

Microsoft

Valve

CES

HSBC

United

Marriott

PepsiCo

Informa

One Events Platform. Endless Brand Potential.

Built with you in mind, our end-to-end event management solutions and technology enabled services support every step of the event life cycle. Plan, grow, and measure every event of any size or complexity with one partner dedicated to your success.

Stova. Elevate the Epic.

MeetingPlay + Aventri + eventcore is now Stova.

Stova’s event management solutions help you simplify event planning for all your all your events from SKO’s and field marketing programs to large scale user conferences or trade shows. More than an event management technology platform, we are your partner for the long term.

One Events Platform. Endless Brand Potential.

Built with you in mind, our end-to-end solution and technology enabled services support every step of the event life cycle. Plan, grow, and measure every event of any size or complexity with one partner dedicated to your success.

Thought Leadership from our Industry Experts

Ready to learn more?

Stova’s event platform elevates your audience experience and puts your attendees in the front row.

Knowledge Newsletter from Stova

Hear from our seasoned event experts when you subscribe to the Stova newsletter. Access our eBooks and guides, industry trends, and latest product updates.